Sales Satisfaction Index

© 2011 Scott Adams, Inc. Dilbert cartoon about customer satisfaction surveys licensed to Pied Piper Management Company LLC

In the motor vehicle industry, a “sales satisfaction index” accurately measures what happens during the time between when…

- a shopper decides to buy a vehicle

and

- the shopper drives away from the dealership, having completed all of the required paperwork

Ironically it can be argued that a “sales satisfaction index” does NOT accurately measure how effectively a sales team sells.

Why? 4 Reasons:

- Ignores 90% of car shoppers. Most car shoppers walk back out the door of a dealership without buying. Sales satisfaction indexes focus primarily, if not entirely, on the customers who bought, ignoring the 90% of vehicle shoppers who visit a dealership-and the salespeople try to sell to-but leave without buying.

- Asks the wrong people the wrong questions. During their visit to a dealership, vehicle shoppers are NOT focused on how effectively a salesperson is "selling." Vehicle shoppers are focused on all kinds of other things (Should I buy this brand or another one? Am I getting the best deal from this dealership? How much will I get for my trade-in? What models and options should I consider? Etc...) When asked about specific salesperson behaviors, even if they answer, vehicle buyers typically weren't focused on these behaviors when they did--or did not-happen, so they really can't accurately answer.

Plus, who your customers ARE can inadvertently affect sales satisfaction index scores: older customers and repeat customers tend to "grade" easier than younger customers and first-time-buyers. Even if salespeople are following identical sales behaviors, this demographic "bias" can distort the results by penalizing a brand selling primarily to younger, first-time buyers and rewarding a brand selling primarily to older, repeat customers. - Relies on 1 customer in 7 who will bother to respond. The low response rate fails to provide enough completed surveys to provide meaningful data for every dealership to allow ongoing measurement, feedback and improvement. Just as concerning is the fact that the one customer who does respond may not be representative of the six who do not. By the way, one of the reasons six out of seven do not respond is customer-satisfaction-damaging "survey fatigue" as we are reminded in Scott Adams' Dilbert cartoon above. What if there were an alternative which did not damage the manufacturer-dealership-customer relationship? More about that in a moment…

- Ignores impact of buyer's satisfaction with vehicle ownership. If car buyers are asked about their car buying experience weeks or months after the fact, the car buyers will be very clear about how satisfied they are with their ownership experience, which will tend to cloud, influence and overpower their response about events which happened weeks or months previously.

What about the bottom line? Does sales satisfaction index performance predict sales success?

The facts suggest NO. In fact, historically when all of the car brands are ranked using a sales satisfaction index, and the brands’ sales performance is then tracked over the next 12 months, a brand’s sales satisfaction index performance is actually NEGATIVELY CORRELATED with the brand’s future sales success.

So are we throwing stones at the whole sales satisfaction index concept? NO. Absolutely not. Sales satisfaction index measurements are very useful. It’s just that the term may be a bit misleading.

Maybe sales satisfaction index measurements should be more accurately called a “Delivery Satisfaction Index.” Why? Because sales satisfaction index measurements do accurately measure how dealerships handle a vehicle’s delivery… How quickly the transaction was completed, how efficiently the dealership handled the “F&I” process, how effectively the salesperson explained all of the new vehicle’s features, etc.

O.K., I understand. A sales satisfaction index accurately measures what happens between when a shopper decides to buy and when they drive away from the dealership. But what about measuring how effectively dealerships sell from their first contact with a shopper (often by internet or telephone) all the way through the shopper’s decision whether or not to buy? How can we accurately measure that; and for all car shoppers, not just those who decided to purchase?

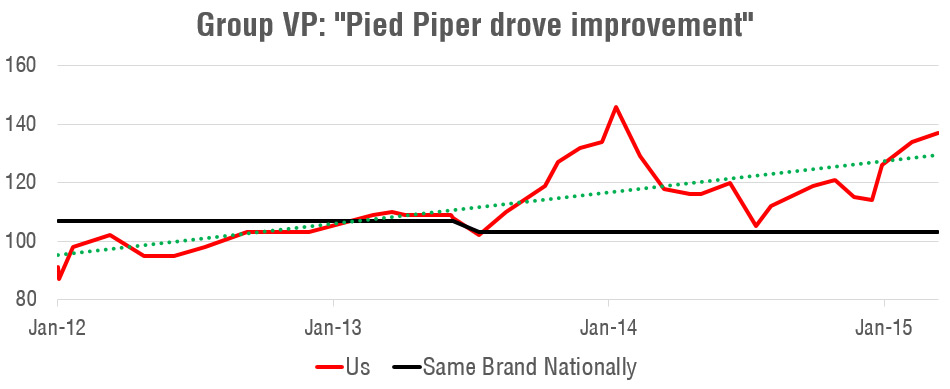

The answer is a patent-pending business process: the Pied Piper Prospect Satisfaction Index® which applies a unique facts and science approach to traditional “mystery shopping” to answer the question, “How effectively did a dealership’s sales team sell?” And more importantly, “What can be done to improve?”

Go to www.piedpiperpsi.com for more details.